Social Justice Warriors Make Bad Financial Advisors

Posted on May 23, 2018 in Money, Public Policy by Nathan Cherry

I think financial advisors do great work for people. Everyone should have a competent financial professional that they can call on to help with the ever changing landscape of personal finance. But who you choose as your financial advisor can make all the difference in the world.

I think financial advisors do great work for people. Everyone should have a competent financial professional that they can call on to help with the ever changing landscape of personal finance. But who you choose as your financial advisor can make all the difference in the world.

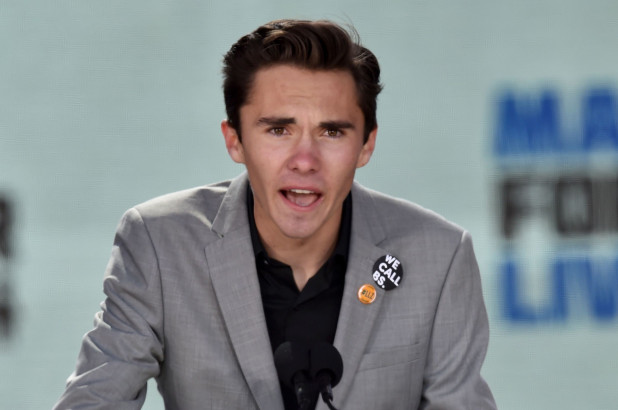

If you were thinking of choosing David Hogg, the Parkland shooting survivor and anti-gun activist as your financial advisor, you might want to reconsider.

Hogg gained a measure of fame after he spoke at a anti-gun rally in Washington, D.C. following the shooting at his high-school in Parkland, FL that resulted in the loss of 17 lives. Following the rally Hogg called for a boycott of The Laura Ingraham show after she mocked him for complaining about not getting into the colleges he applied for. Those efforts resulted in numerous advertisers pulling their funding and a drop in ratings for Ingraham.

After the success of his media tour and boycott of Ingraham, Hogg decided to take on two of the largest investment groups in the world by calling for a boycott of BlackRock and Vanguard.

Tweeting to his army of Twitter activists, Hogg said: “.@blackrock and @Vanguard_Group are two of the biggest investors in gun manufacturers; if you use them, feel free to let them know,” as reported by The Washington Times. Hogg apparently expected the same kind of success as he saw from the Ingraham boycott.

His efforts have been a dismal failure.

The reason both BlackRock and Vanguard have seen no adverse consequences from Hogg’s efforts are easy to understand.

First, Blackrock and Vanguard are well established firms with a broad client base made up of people from around the world. Together, BlackRock and Vanguard manage more than $10 trillion in assets. Their strength as investment managers cannot be questioned.

A second, more important reason this effort failed is because both BlackRock and Vanguard do not rely on advertisers for their revenue. Unlike Ingraham, a show relying on revenue from advertisers that are risk-averse and seek to avoid controversy, investment groups have no advertising revenue. What Hogg didn’t realize is that he was asking individual investors and employers using BlackRock and Vanguard funds in their retirement accounts to take action. A request that likely fell on deaf ears.

Hogg likely neglected to realize his Twitter army is composed of millennials and other activists looking to take on the gun industry. It’s entirely possible that most of Hogg’s Twitter followers don’t even have an investment account. The question his team of PR advisers might have forgotten to ask is “how many of these followers have influence in the investment management space?” The answer is clearly: none.

Hogg asking his followers to lobby investment managers like BlackRock and Vanguard is like holding one share of Netflix stock but demanding to control the content on their platform or you will sell your share. It’s laughable.

This effort also lacked the support of left-leaning groups like Media Matters that helped take his Ingraham boycott far and wide. Without the support of someone bigger and more influential than himself, Hogg was left without a leg to stand on.

So the boycott was a spectacular failure.

Both BlackRock and Vanguard have reported no changesince the boycott effort. And Vanguard’s fund for clients no wanting to invest in gun manufacturers has seen no change either.

And The Laura Ingraham showhas seen a return of both advertisers and ratings. Meaning the effects of Hogg’s calls for boycott only lasted as long as the media coverage given to them.

Here’s a lesson for David Hogg before he tries to start another boycott via tweet. Investment managers don’t make knee-jerk decisions based on emotion. Financial fundamentals are a key to composing and maintaining a profitable portfolio of investments. A couple of the fundamentals driving the gun manufacturing and ammunition industry include defense contracting, global supply and demand, and homeland security. These are not fundamentals likely to change anytime soon.

What this means for investment management firms like BlackRock and Vanguard is that they are not likely to divest from gun and ammunition stock anytime soon. But this should be a welcome reality for investors. Decisions about where to invest are not based on emotion but on sound fundamentals and doing what is best for investors. People don’t pay their investment managers to make emotional decisions or react to Tweet’s from high-school social justice warriors.

Vanguard is already showing their wisdom by having a portfolio for investors opposed to investing in gun manufacturers. So even if a large group of investors shared their opposition to investing in guns, they would simply be redirected to this portfolio while everyone else remained invested in guns, defense, and ammo.

The lesson: teenagers without real-world experience don’t make the best financial advisors.